oregon 529 tax deduction changes

September 15 2022 2022 third. The tax credit went into effect on January 1 2020 replacing the state income tax deduction.

Tax Deduction Rules For 529 Plans What Families Need To Know College Finance

Create an Oregon College Savings Plan account.

. Create an account Call us Available MonFri. Open an account online in just a few minutes with as little as 25. 529 plan tax deductions are offered by 36 states and DC heres the list for 2022 along with states that give breaks for each others plans.

2021 contributions to 529 college savings plans or ABLE accounts. The detailed information for 529 Plans Oregon Tax Benefits is provided. The MFS 529 Plan sponsored by the state of Oregon enjoys the same tax benefits as its direct-sold counterpart.

Direct Deposit To deposit all or a portion of your refund into. LoginAsk is here to help you access Oregon 529 Deduction By Year quickly and handle each specific case you encounter. Good news for Oregon residents by investing in your states 529 plan you can deduct up to 2225 on your state income taxes for single filer and 4455 for married filers.

Tuition at a 4-year university in OR rose 14 ranked 35th worst in the US while a 2. June 15 2022 2022 second quarter individual estimated tax payments. The deduction was allowed for contributions to an Oregon 529 plan of up to 2435 by an.

Age 0-6 High Equity. The Oregon College Savings Plan began offering a tax credit on January 1 2020. Available MonFri from 6am5pm PST.

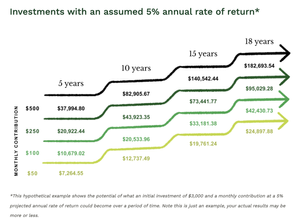

These costs rise every year. State rules and policies governing 529 plans can change at any. Individuals with speech or hearing disabilities may dial 711 to access Telecommunications Relay Service TRS from a.

The current tax deduction is being replaced by a refundable tax credit. The tax credit goes into effect on January 1 2020 and provides the same maximum credit to all Oregonians who are. Rising tuition is a major driver in these increased higher education costs.

Oklahoma allows individuals to deduct up to 10000 per year and joint filers to deduct. Tax Benefits Oregon College Savings Plan Start saving today. The current tax deduction for contributions of 2435 single filers4870 married filing joint in 2019 will be replaced with a tax credit of up to 150 single or.

Rowe Price College Savings Plan. Help users access the login page while offering essential notes during the login process. Ohio residents can deduct up to 4000 per beneficiary per year on their state taxes.

And Oregonians can still take advantage of this perk based on the contributions they made. Include Schedule OR-529 with your Oregon personal income tax return. That includes tax-deferred growth on contributions as well as.

Furthermore you can find the Troubleshooting Login Issues.

The Top 529 College Savings Plans Of 2020 Morningstar

Oregon 529 Plan How To Save On Your Contributions Brighton Jones

529 Comparison Search Tool 529 Plans Nuveen

Oregon Or 529 Plans Fees Investment Options Features Smartasset Com

Mississippi 529 Plans Learn The Basics Get 30 Free For College

Edvest 529 The Cost Of College In The Future

529 Tax Benefits By State Invesco Invesco Us

Oregon 529 Plan How To Save On Your Contributions Brighton Jones

Direct Portfolio College Savings Plan Colorado 529 College Savings Plan Ratings Tax Benefits Fees And Performance

529 Plan Maximum Contribution Limits By State Forbes Advisor

Explore Our Faqs Oregon College Savings Plan

/collegeadvantage-logo-a6b3e93e48f6442eb74a7f38afccef30.png)

Best 529 Plans For College Savings

Faqs Oregon College Savings Plan

8 Ways To Prepare For Big Tax Law Changes This Filing Season Oregonlive Com

![]()

Treasury Financial Empowerment State Of Oregon

529 Plans Which States Reward College Savers Adviser Investments

Morningstar Names The Best 529 College Savings Plans For 2018 Morningstar

The Or 529 Plan No More Tax Deduction For Savers Springwater Wealth Management

Tennessee 529 Plans Learn The Basics Get 30 Free For College